Summary:

The banking industry is evolving faster, and staying ahead of the curve is mandatory to remain competitive. Automation continues to revolutionize the modern banking industry, and leveraging it now is the best option to succeed. RPA in banking is a technology evolution that automates repetitive tasks and streamlines processes, allowing banks to operate more efficiently and effectively. This blog will cover how RPA is revolutionizing the Banking industry, its benefits, real-life use cases, and its relevance. So, fasten your seatbelts as we embark on a journey to discover the untapped potential of robotic process automation in banking.

Table of Contents

Introduction

Robotic Process Automation (RPA) has emerged as a valuable tool in the banking and financial sector, offering various benefits to organizations. By reducing repetitive tasks and streamlining operations, RPA helps banks and financial institutions lower operational costs by 30% – 70% and increase efficiency and accuracy.

Automation bots enable lenders to automate loan processing, including customer information collection, approval, monitoring, and pricing. With rule-based software bots, lenders can achieve a balance between automated and manual processes, adapting to evolving trends and enhancing security measures. RPA also plays a crucial role in mitigating fraud risks through reassessing processes, eliminating human errors, automated threat detection, and anomaly search.

RPA in banking and financial institutions can enhance their services and help them stay ahead in today’s competitive landscape.

RPA In Banking - Unlocking Success Through Automation

In recent years, the global RPA market has witnessed significant growth. According to Global Research Report, the RPA market size is projected to reach USD 2,942.7 million in 2023 and USD 30,850.0 million by the end of 2030, growing at a CAGR of 39.9%. Besides, the Banking and Financing Services Industries (BFSI) hold the most significant chunk of revenue share in 2022 (about 28.8% of the overall market).

RPA Helps Banks in Overcoming Day-to-Day Challenges

Bank employees often handle large volumes of customer data, making manual processes susceptible to errors. Manual processing of banking operations can lead to mistakes, which can have serious consequences such as theft, fraud, and money laundering. Replacing manual data processing with bots makes completing simple tasks like validating customer information from multiple systems in seconds instead of minutes. Introducing bots for manual processes can significantly reduce processing costs. Automating various processes in banks also frees the workforce to focus on more critical tasks.

Here are some day-to-day challenges faced by banks:

🟠 Manual Data Entry:

Banks often face the challenge of manually entering customer data into their systems, which is time-consuming and prone to errors.

🟠 Tedious Document Processing:

Banks deal with numerous documents, such as loan applications and account opening forms, which must be reviewed and processed manually, leading to delays and inefficiencies.

🟠 Complex Regulatory Compliance:

Banks must comply with various regulations and standards, such as KYC (Know Your Customer) and AML (Anti-Money Laundering), which involve extensive paperwork and verification processes.

🟠 Legacy Systems Integration:

Many banks still need to rely on outdated legacy systems that must be more easily integrated with modern technologies, hindering seamless data flow and collaboration.

🟠 Siloed Communication:

Ineffective communication between different departments and branches can result in miscommunication, delays in decision-making, and improved customer service.

🟠 Lack of Real-Time Insights:

Banks often need help obtaining real-time insights into their operations, making it challenging to identify and address issues promptly.

🟠 Traditional Reconciliation Processes:

Reconciling accounts, transactions, and balances manually can be time-consuming and error-prone, leading to discrepancies and delays in financial reporting.

🟠 Lack of Data Management:

Banks often have data spread across multiple systems and departments, making it difficult to have a unified and comprehensive view of customer information.

🟠 Security Vulnerabilities:

With the increasing sophistication of cyber threats, banks must constantly enhance their security measures to protect sensitive customer data from breaches and attacks.

🟠 Inefficient Customer Onboarding:

Lengthy and complicated customer onboarding processes can frustrate potential customers, leading to lost business opportunities and a negative customer experience.

If you analyze the use cases of RPA in banking, you will know how it offers a powerful and efficient way to overcome the pain points faced by banks. Robotic Process Automation eliminates manual errors and significantly reduces processing time by automating repetitive and rule-based tasks. It leads to improved accuracy, enhanced productivity, and streamlined operations.

With RPA, banks can seamlessly integrate disparate systems and legacy platforms, enabling smooth data flow and real-time insights. Automating compliance processes ensures adherence to regulatory requirements, reducing the risk of penalties and reputational damage.

Navigate The Future Of Banking With Unstoppable RPA Prowess!

Look no further! Ignite the spark of innovation within your institution by hiring a visionary RPA developer equipped with the finest technological compass to navigate complex processes.

RPA Use Cases in Banking

RPA is revolutionizing operations in the banking industry by automating repetitive tasks, reducing errors, and enhancing efficiency. In the following RPA use cases in banking, you will notice how it streamlines processes like account origination, loan processing, compliance, and customer service. RPA enables faster transactions, improved risk management, cost savings, and an enhanced customer experience, driving banks toward digital transformation.

Accounts Payable

The accounts payable process is essential for businesses, involving invoice processing, payment approvals, and vendor communication. RPA automates accounts payable processes, extracting invoice data, validating it, and automating approval workflows. It saves time, reduces errors, and streamlines vendor communication.

Examples of RPA use cases in Banking for accounts payable process include Invoice processing, Payment approvals, and Vendor communications. It helps streamline invoice processing by extracting data, updating records, automating payment approvals, and enhancing vendor communication through automated email notifications.

Customer Service

One of the amazing RPA use cases in banking is automating customer service. RPA revolutionizes customer service by automating repetitive tasks, improving response times, and enhancing customer satisfaction. For instance, RPA can automate email responses, chatbot interactions, and customer data retrieval, enabling agents to focus on complex inquiries and providing personalized support.

Examples of RPA in Banking include:

- Automated ticket routing.

- AI-powered chatbots for instant responses.

- Automated customer data validation for quicker issue resolution.

With RPA, businesses can deliver exceptional customer experiences and build long-term relationships.

Compliance

By adhering to the regulations and laws put forth for the banking industry, Robotic Process Automation plays a pivotal role in automating the compliance process. It helps automate data collection, analysis, and reporting processes, ensuring compliance directives and audit guidelines are followed. Besides, it also helps in mitigating risks associated with compliance issues.

For example, RPA can automatically extract relevant data from multiple systems to generate compliance reports, monitor transactional activities for suspicious behavior, and validate customer information against regulatory databases.

Loans

For instance, a customer considers to apply for a VA home loan or other types of mortgages. Banks are empowered to provide faster, more precise loan services leveraging RPA technology. RPA helps banks automate the verification of loan documents, customer data collection, loan origination forms, and segregation of loan types. Besides, it also streamlines credit scoring and underwriting processes, analyzing data and providing real-time risk assessments. Leveraging robotic process automation in Banking, financial institutions, and lenders expedite loan approvals, reduces processing time, and enhances overall operational efficiency to deliver customers a seamless and satisfying experience.

Examples of RPA in automating loan processes include payment processing, interest rate adjustments, monitoring of loan performance, generating approval documents, credit bureaus, and financial statements, ensuring compliance, and reducing the risk of fraud.

KYC

The Know Your Customer (KYC) process is crucial to customer onboarding in the banking industry. RPA automates data extraction and validation, streamlines risk assessment, automates document management, enables compliance monitoring, and enhances the customer experience in the KYC process.

Real-life examples of RPA in banking automating the KYC process include automated extraction of customer data from scanned identification documents, automated screening against sanctions lists and watch lists, and automated generation of KYC reports for compliance purposes.

Fraud Detection

By leveraging advanced algorithms and real-time data analysis, RPA helps identify suspicious patterns and potentially fraudulent activities. RPA monitors transactions, analyzes data, applies rules, streamlines case management, and adapts to emerging fraud techniques. In this particular RPA use cases in banking, RPA works by detecting unusual spending patterns, cross-referencing transactions, generating reports, and continuously improving its fraud detection capabilities.

For example, RPA revolutionizes fraud detection by automating monitoring, integrating data, applying rules, streamlining case management, and adapting to emerging threats.

Benefits of Robotic Process Automation in Banking

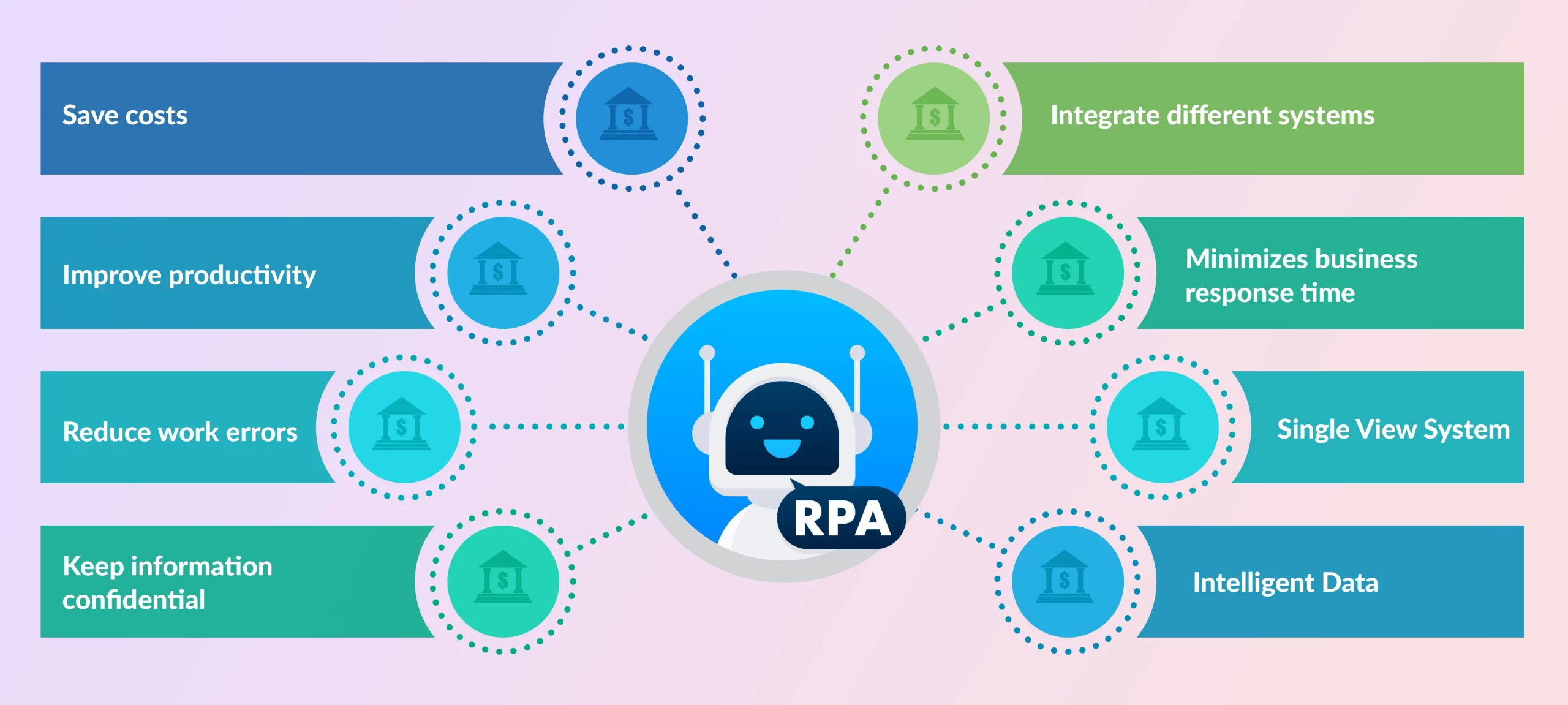

Robotic Process Automation (RPA) revolutionizes the banking industry by offering a range of compelling benefits. From cost savings and improved productivity to enhanced data accuracy and streamlined processes, RPA empowers banks to drive operational efficiency, elevate customer experiences, and stay ahead in the ever-evolving digital landscape.

🟠 Save Costs:

RPA implementation reduces expenses by 25% to 75%, improving performance while maintaining quality, resulting in significant savings for banks.

🟠 Improve Productivity:

RPA frees up human resources for higher-value tasks, enabling a more efficient “machine + human” team dynamic and global operations round the clock.

🟠 Reduce Work Errors:

With correct logic settings, RPA minimizes errors caused by manual processes, ensuring reliable and accurate data processing.

🟠 Keep Information Confidential:

Unlike outsourcing, RPA in banking keeps confidential information securely within internal staff management, safeguarding customer data.

🟠 Integrate Different Systems:

RPA seamlessly integrates various work processes and system architectures, allowing for flexible deployment and scalability.

🟠 Minimizes Business Response Time:

RPA enables standardized and prompt customer interactions, enhancing the customer experience and simultaneously serving a large customer base.

🟠 Single View System:

Legacy system integration through RPA reduces manual effort, verifying information from multiple systems and ensuring data consistency.

🟠 Intelligent Data:

RPA in Banking leverages context-aware knowledge to deliver faster and more precise results, bridging knowledge gaps without manual intervention.

The Best Approach to Implement RPA in Banking

By taking these essential steps, prepare to transform your bank’s future with RPA.

Step 1: Unleashing the Power of RPA with a Smart Strategy

Begin with an in-depth economic viability analysis, calculating the return on investment after adopting RPA in banking. Evaluate your existing system, map out key stakeholders, and determine the feasibility of process automation. Consider factors such as automation costs, change management, and estimated returns, ensuring a seamless transition to a more efficient and scalable future.

Step 2: Unlock the Potential with Strategic Pilot Processes

Let’s dive into the heart of implementing robotic process automation in Banking by identifying the perfect pilot processes. Analyze the scope and compatibility with your current baseline to make informed choices. We recommend starting with basic repetitive tasks, cross-system validations, and stable operation management systems. This targeted approach minimizes the learning curve and mitigates the risk of potential hiccups, ensuring a successful RPA journey.

Step 3: Embrace Challenges, Transform with Confidence

Navigating through transformation requires a keen eye for both internal and external challenges. Dive deep into critical analysis, understanding the factors that shape your journey. Ensure compliance with statutory obligations, carefully studying government regulations. Internally, address any resistance from employees who fear the unknown. Transparent communication, comprehensive training, and active engagement foster trust and empower your team to embrace change, unlocking valuable insights. Together, we’ll conquer the challenges and embark on a successful transformation.

Step 4: Unleash Automation Power, Tailored to Your Needs

With the workflow mapped out, it’s time to bring your vision to life. Choose the sourcing method that aligns seamlessly with your selected automation process. In the upcoming section, we’ll unveil three sourcing modes specifically tailored for banks, empowering you to harness the full potential of RPA in banking. Get ready to witness the transformation, customized to suit your needs.

Step 5: Embrace the Power of Automation Across the Board

After gathering valuable insights from the pilot testing, it’s time to take the leap and scale up your automation implementation. Expand the application of RPA in banking beyond the pilot phase and embrace its transformative potential across the enterprise. Get ready to witness the ripple effects as automation revolutionizes your banking operations on a grand scale.

Conclusion

Throughout the blog, we have explored the remarkable impact of RPA in banking industry. From automating mundane tasks to streamlining complex processes, RPA has emerged as a game-changer, driving significant benefits for banks.

RPA is a transformative solution for the banking sector, addressing common pain points, streamlining processes, and unlocking new opportunities. By embracing robotic process automation in banking operations, banks can harness its potential to elevate their operations, stay competitive in a rapidly evolving industry, and deliver exceptional value to customers. With its ability to automate tasks, drive efficiency, and enhance decision-making, RPA paves the way for a future where banks can truly excel in their pursuit of excellence.

Frequently Asked Questions (FAQs)

RPA transforms banking operations by automating data collection, validation, and document processing, resulting in faster and more accurate processes. It enhances customer service by enabling quicker response times, personalized interactions, and efficient handling of inquiries, ultimately improving the overall customer experience.

RPA never intends to replace human workers, but to augment their capabilities. While RPA automates repetitive tasks, human employees can focus on more complex and strategic activities that require critical thinking and decision-making. RPA and humans can work together collaboratively, leveraging the strengths of both to enhance overall banking operations.

Real-life examples of RPA in banking include automating loan processing, where RPA bots extract data from loan applications, validate information, and streamline the approval process. RPA is also used for Know Your Customer (KYC) verification, where it automates data extraction from identification documents and performs compliance checks. Additionally, RPA assists in fraud detection by analyzing transactions and identifying suspicious activities.

RPA plays a vital role in ensuring regulatory compliance in banking. It continuously monitors transactions, customer behavior, and system logs to identify anomalies or non-compliant activities. RPA applies predefined rules and algorithms to assess transactions, flagging suspicious ones for further investigation. By automating compliance monitoring, RPA helps banks adhere to anti-money laundering (AML) regulations and other regulatory frameworks.

Successful implementation of RPA in banks requires careful planning and execution. Banks should start with a comprehensive analysis of processes and identify suitable areas for automation. It is essential to address internal and external challenges, including change management and employee resistance. Banks should also choose the right automation tools and develop a roadmap for scaling RPA across the organization. Regular monitoring and evaluation of RPA performance are crucial for ongoing success.

Your Success Is Guaranteed !

We accelerate the release of digital product and guaranteed their success

We Use Slack, Jira & GitHub for Accurate Deployment and Effective Communication.