Quick Summary:

Want to build a breakthrough application in the FinTech domain? Ensure that the backend technology is robust, secure, and scalable. Ruby on Rails for FinTech has proved to be the right fit due to its features and advantages. This blog covers the challenges faced by the FinTech industry and how choosing Ruby on Rails for Finance app development can help entrepreneurs succeed. Also, find out about successful FinTech startups using Ruby on Rails in their backend.

Table of Contents

FinTech Industry Insights

The FinTech industry has witnessed significant growth in recent years, adopting new technologies such as artificial intelligence, blockchain, and cloud computing. Additionally, due to changing consumer preferences, traditional financial institutions face competition from innovative FinTech startups. With continuous technological evolution, the FinTech industry is also adopting emerging trends like mobile payments, digital currency, InsurTech, digital lending, and more.

The digital payment industry is expected to reach $6.7 trillion in transaction value by 2023, growing at a CAGR of 12.7% from 2019 to 2023. (Source: Capgemini).

The global mobile banking market is expected to grow from $715.3 billion in 2020 to $1.82 trillion by 2026, growing at a CAGR of 16.4% during the forecast period. (Source: ResearchAndMarkets)

The FinTech industry offers immense scope for startups due to its rapidly growing market and disruptive potential. The only criticality here is the choice of tech stack for FinTech app development.

This blog will show how Ruby on Rails for FinTech startups performs reliably and efficiently. We will also get insights into the lurking challenges and issues for a FinTech business owner.

Ruby on Rails for FinTech: Why is it an Ideal Fit?

As you plan to proceed with your FinTech app development or consider building Ruby Blockchain or Cryptocurrency Rails or connecting to an Ethereum network using a Ruby on Rails gem, here is what you must know about Ruby on Rails.

The development style of RoR, along with its characteristics & framework capabilities, make Ruby on Rails the right choice for a FinTech startup.

Rapid Development

RoR is known for its ability to rapidly prototype and develop web applications because of its exceptional features and functionality: convention over configuration, modular design, test-driven development, third-party libraries & plugins.

Such robust and quick development is essential for Fintech startups that must bring new products to market and help them remain competitive quickly.

Robust Ecosystem

RoR has a large and active community of developers, which means that there are many resources available for Fintech startups to leverage. This can include pre-built libraries and plugins for standard Fintech functionality and forums and support communities for troubleshooting and problem-solving.

Agile Methodology

RoR is well-suited to an agile development methodology, a popular software development approach in Fintech startups. This approach emphasizes flexibility and adaptability, which can be crucial for rapidly evolving Fintech products. A reputed agile software development company like Bacancy can rightly guide your Fintech app development using Ruby on Rails.

Cost-effective

RoR is an open-source framework, which means that it is free to use and can be cost-effective for Fintech startups that may not have a large budget for software development.

As you are clear with the benefits of app development using Ruby on Rails and FinTech market scope, let us find out the issues currently concerning FinTech startup owners.

Ready to disrupt the FinTech space with a cutting-edge app?

Hire Ruby on Rails Developer from us to help you create a seamless transactional experience that sets you apart from the competition.

Challenges of the FinTech Industry

Being a FinTech industry owner, you might be concerned about some aspects that matter to the FinTech application user. Security, traffic, and analytics are the prime concerns; let us check them in depth.

1. Security

Security is a significant challenge for FinTech startups. FinTech applications deal with sensitive financial data, which makes them attractive targets for cybercriminals. FinTech startups must ensure that their applications are highly secure and follow best practices for cybersecurity. This includes implementing strong authentication and encryption measures, monitoring potential security threats, and planning to respond to security incidents. Failing to secure a FinTech application properly can result in a loss of trust from customers, reputational damage, and financial losses.

2. High Traffic

High traffic is another common issue faced by FinTech applications. FinTech apps need to handle a large volume of user traffic & hence business owners need to ensure that their applications can support many users without slowing down or crashing. FinTech applications typically require a high degree of availability and performance, as users expect to be able to access their financial data and conduct transactions in real-time.

3. Analytics

FinTech startups need strong analytical capabilities because data is at the heart of the FinTech industry. Analyzing data can provide valuable insights into customer behavior, transaction patterns, and market trends that can inform business strategy and drive growth.

One key area where analytics is crucial for FinTech startups is risk management. FinTech applications deal with sensitive financial data and must be able to detect and prevent fraudulent activities. Strong analytical capabilities can help FinTech startups identify fraudulent behavior patterns and take proactive steps to prevent fraudulent transactions. Analytics can also help FinTech startups to assess credit risk and make data-driven decisions about lending.

How Ruby on Rails for FinTech can Eradicate the Challenges?

Ruby on Rails has what it takes to build a reliable, robust, and efficient Finance application. It will rightly overcome the core issues that FinTech startups face. Here is how Ruby on Rails for FinTech app development is a heavenly match.

1. RoR for FinTech resolves Security Issues

RoR is designed with security in mind and includes many built-in features that make it easier for developers to create secure applications. RoR has several security features, including cross-site scripting (XSS) protection, SQL injection protection, and protection against CSRF (Cross-Site Request Forgery) attacks. These features make it harder for attackers to exploit common vulnerabilities.

2. RoR Scalability overcomes the Traffic Surge Challenges

The RoR framework can help FinTech startups to overcome traffic surge issues by providing scalability in several ways:

Horizontal scaling:

RoR allows FinTech startups to scale horizontally by adding more servers or instances to handle increased traffic. RoR is designed to work well with cloud-based infrastructure, which can help FinTech startups quickly and easily add more instances as needed to handle traffic surges.

Caching:

RoR includes built-in caching mechanisms that can help FinTech startups improve their applications’ performance by reducing the number of requests that need to be made to the database. By caching frequently accessed data, RoR can help reduce the database load and improve application performance during traffic surges.

Asynchronous Processing:

RoR supports asynchronous processing, which can help to improve application performance and handle traffic surges by allowing requests to be processed in the background. This can help to free up resources and reduce the load on the application server during traffic surges.

Load Balancing:

RoR works well with load-balancing solutions that can help FinTech startups to distribute traffic across multiple servers or instances. Load balancing can help improve application performance and ensure the application remains available during traffic surges.

Overall, RoR’s scalability features can help FinTech startups to overcome traffic surge issues by providing horizontal scaling, caching, asynchronous processing, and load balancing. By leveraging these features, FinTech startups can ensure their applications remain available and performant, even during traffic surges.

3. RoR Data-analysis Integration to overcome Analytics Challenges

Ruby on Rails (RoR) can integrate with data analysis tools to help FinTech startups overcome the analytics challenge in several ways:

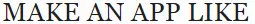

Data Visualization:

RoR can integrate with data visualization tools like D3.js, Chart.js, and Highcharts to provide interactive and informative data visualizations. Data visualization can help FinTech startups to understand their data better and identify trends and insights that may not be apparent in raw data.

Data Warehousing:

RoR can integrate with data warehousing solutions such as Amazon Redshift and Google BigQuery to store and manage large volumes of data. Using data warehousing helps FinTech startups to consolidate data from multiple sources and perform complex queries and analyses.

Machine Learning:

RoR can integrate with machine learning tools such as TensorFlow and Scikit-learn to perform predictive analysis and make data-driven decisions. Machine learning can help FinTech startups to identify patterns in data and predict future behavior, such as identifying high-risk customers or predicting market trends.

Transform your FinTech Industry with a Creative and Powerful App!

Partner with our Ruby on Rails Development Company and watch as we create a masterpiece that takes transactions to the next level.

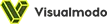

Which Frontends Perform Well with Ruby on Rails Backend for FinTech Apps?

When it comes to frontend frameworks, several options work well with Ruby on Rails for building FinTech apps.

ReactJS

ReactJS is a widely used frontend framework that works well with Ruby on Rails for building FinTech apps. It is known for its modular architecture, fast rendering, and reusable components. ReactJS can be easily integrated with Ruby on Rails using the React-Rails gem, which provides a set of helpers and generators to streamline the development process.

AngularJS

AngularJS is another popular frontend framework that can be used with Ruby on Rails for building FinTech apps. It provides a comprehensive set of tools for building complex web applications, including data binding, dependency injection, and routing. AngularJS can be integrated with Ruby on Rails using the angular-rails gem, which provides a set of generators and directives for developing AngularJS applications.

Vue.js

Vue.js is a progressive frontend framework that can be used with Ruby on Rails for building FinTech apps. It is known for its simplicity, flexibility, and performance. Vue.js can be integrated with Ruby on Rails using the vuejs-rails gem, which provides a set of generators and helpers for developing Vue.js applications.

Ember.js

Ember.js is a frontend framework that can be used with Ruby on Rails for building FinTech apps. It provides a robust set of tools for building complex web applications, including data binding, routing, and testing. Ember.js can be integrated with Ruby on Rails using the ember-rails gem, which provides a set of generators and helpers for developing Ember.js applications.

In conclusion, ReactJS, AngularJS, Vue.js, and Ember.js are all remarkable frontend frameworks that can be used with Ruby on Rails for building FinTech apps. The choice of frontend framework ultimately depends on the project’s specific requirements and the development team’s expertise.

RoR for FinTech: Real Case Studies

Many FinTech companies are using Ruby on Rails in their backend, including:

Coinbase

Coinbase is a popular and one of the largest cryptocurrency exchange platforms in the US that use Ruby on Rails to handle user authentication, payment processing, and other backend functions. The platform recorded 103 million users in 2022.

Robinhood

Robinhood is a commission-free investing app that uses RoR to power its backend. The app also enables stock trading. Ruby on Rails scalability helps Robinhood to handle the large volumes of trades that take place on the platform. The net income of the company in 2022 was US $1.03 billion.

Betterment

Betterment is an American financial advisory company that uses Ruby on Rails to handle user authentication, account management, and investment recommendations. The platform will host 91,00,000 accounts in 2023. They overcome UX design challenges because of the DRY principle of Rails components.

Stripe

Stripe is a payment processing platform that uses RoR to handle backend functions such as billing, invoicing, and transaction management. The company was valued at US $94.4 billion in 2022.

Overall, the role and involvement of Ruby on Rails in FinTech industries are majestic, and Finance companies use Rails due to its emphasis on rapid development, scalability, and security. Many FinTech companies use RoR to handle critical backend functions such as payment processing, account management, and data analysis.

Conclusion

Knowing the essence of security and traffic challenges in the Finance industry, you are now confident that Ruby on Rails for FinTech serves the best output. Selecting the right full-stack development company which can meet your FinTech app frontend, as well as robust backend like RoR, is vital. Materialize your dreams in a FinTech giant success!

Frequently Asked Questions (FAQs)

Devise, Stripe, Pundit, Paperclip, RSpec, and Sidekiq are some essential Ruby on Rails gems useful for FinTech app development. They provide a wide range of functionality, including user authentication and authorization, payment processing, authorization management, file attachment handling, testing, and background job processing. These gems can significantly simplify the development process and improve the functionality and performance of FinTech applications built using Ruby on Rails.

Finance applications need to cover security and high-traffic management for best user experience. Ruby on Rails for FinTech backend is an ideal preference as it matches the security, traffic, & analytics parameters. Whereas, for a flawless frontend, technologies like ReactJs, Angular, Vue.js, EmberJS etc. pair up well with RoR.

Ruby on Rails supports payment processing in FinTech applications through various payment processing gems such as Stripe, Braintree, and PayPal. These payment processing gems provide APIs that can be integrated into the Ruby on Rails application to process payments securely.

Your Success Is Guaranteed !

We accelerate the release of digital product and guaranteed their success

We Use Slack, Jira & GitHub for Accurate Deployment and Effective Communication.