Summary

Fraud is a constant threat, but AI is emerging as a powerful weapon in the fight to protect consumers and businesses. This blog dives into AI-powered fraud detection, exploring how it works, the different types of fraud it can combat, and the key benefits it offers.

Table of Contents

Introduction

It takes only a single click for someone with malicious intent to transfer millions of dollars from one account to another. Who knows, that account losing the money could be yours. You can be defrauded in multiple ways, like card-not-present theft, identity fraud, phishing attacks, and much more than you can imagine. The attacks are pretty sophisticated, and the victims – anyone from an individual to an organization. Every time a fraud happens, it leaves behind a scarred financial toll and a maligned reputation.

But all the mental agony and financial strain ends if the approach changes, meaning one becomes wiser and focuses on a proactive rather than a reactive approach. That starts with adopting an AI fraud detection strategy. GBG suggests that the ML model and rule-based fraud systems deployment helped identify new complex security vulnerabilities (leading to financial fraud), improving accuracy by up to 30%.

This blog discusses detecting and preventing financial and data fraud using Artificial Intelligence. We can promise you that by the end of this blog, you will fully understand what to do – you might have to work on how to do it. Don’t worry; we’ll even help you with that.

How Artificial Intelligence Detects Fraud?

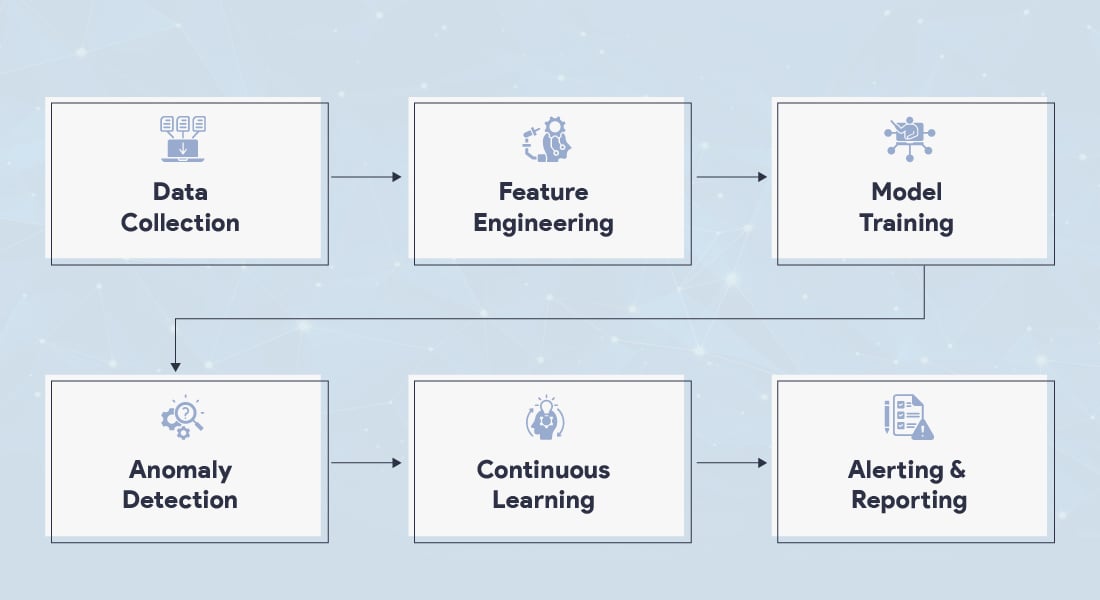

Fraud is present in every aspect of society, and identifying and stopping fraud is a crucial research concern for various entities. The increase in big data and artificial intelligence has provided new possibilities in utilizing sophisticated machine learning algorithms to identify fraud. So, let’s understand the technicalities of AI in fraud detection.

Integrating Artificial Intelligence (AI) has revolutionized internal security measures and operational efficiency for enterprises. AI has become a critical tool in safeguarding against financial violations, mainly due to its advanced capabilities in data analysis.

By leveraging AI for fraud detection, organizations gain the ability to analyze vast volumes of transactions in real-time, uncovering intricate patterns indicative of fraudulent activity. This real-time analysis empowers them to detect and prevent fraud attempts proactively.

AI models can immediately act upon detecting suspicious activity, such as blocking or flagging transactions for further investigation, with a calculated fraud probability score. Furthermore, AI systems continuously learn and adapt through human-expert interaction.

The successful implementation and ongoing optimization of AI fraud detection systems rely heavily on a skilled team of AI developers. These professionals possess the expertise to develop, deploy, and maintain these complex systems, ensuring their effectiveness in safeguarding the organization’s financial security.

Experience matters; expertise protects. Partner with an AI development company to build a robust defense against fraud. Get a 2-hour free consultation now!

Types of AI Fraud Detection - Industry Wise

“Keep your friends close; keep your enemies closer.”

The above proverb is applied well to understand the fraud and fraudulent mentality. As an individual or organization, it’s crucial to be aware of the different types of digital fraud to protect yourself. We have categorized them by industry for your convenience, allowing you to quickly find the relevant information and learn how we can partner with you to safeguard your assets.

Financial Services

Financial services and banking systems are highly vulnerable to digital fraud and are on the priority list of cyberattackers. I’ve listed how fraudsters work and the AI fraud detection and prevention process.

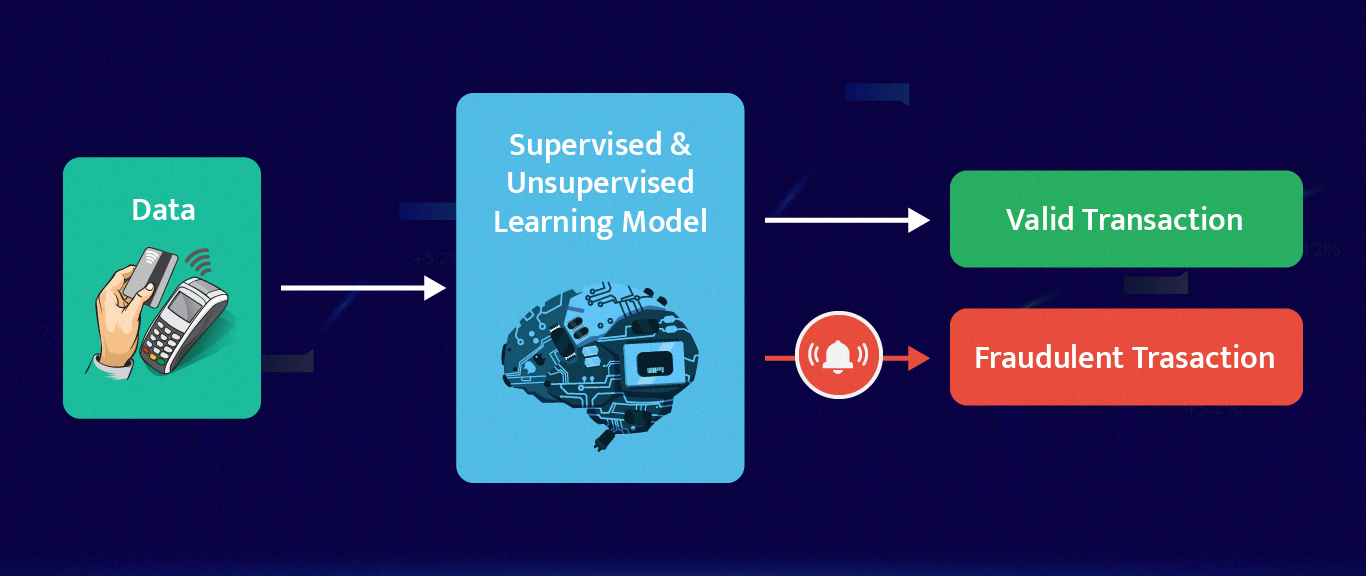

Credit Card Fraud

Credit card fraud is estimated to reach $43 billion by 2026. To combat this, organizations are turning to AI-powered solutions.

The problem: Fraudsters steal credit card information and use it for unauthorized online purchases, over the phone, and even by cloning or skimming cards.

The solution: AI analyzes spending patterns and detects anomalies, like unusual transactions or purchases outside the cardholder’s typical behavior. It helps prevent fraud before it happens, protecting both individuals and organizations.

Payment Fraud

Payment fraud is a significant concern for businesses of all sizes, causing billions of dollars in losses globally each year. However, proactive steps can be taken to prevent such fraud.

The problem: Fraudsters can obtain credit card details, bank account numbers, or login credentials through various means, like phishing scams, data breaches, or malware attacks. They can even create fake identities and accounts for fraudulent transactions. This fraud occurs online or over the phone, where the cardholder cannot verify the transaction physically.

The solution: Businesses can utilize multifactor authentication (MFA) to add an extra layer of security. They can implement AI fraud detection systems to analyze data in real-time, identifying suspicious patterns and anomalies indicative of potential fraud attempts. This helps catch fraud attempts before they drain valuable resources.

Account Hacking

Your online accounts hold valuable information, making them targets for unauthorized access. Fortunately, proactive measures can bolster your defenses.

The problem: Hackers use various tactics, like phishing scams, keyloggers, and malware, to steal login credentials and gain access to accounts. Once they get access to critical information of your account, they can wreak havoc, steal personal data, make fraudulent transactions, or damage your reputation.

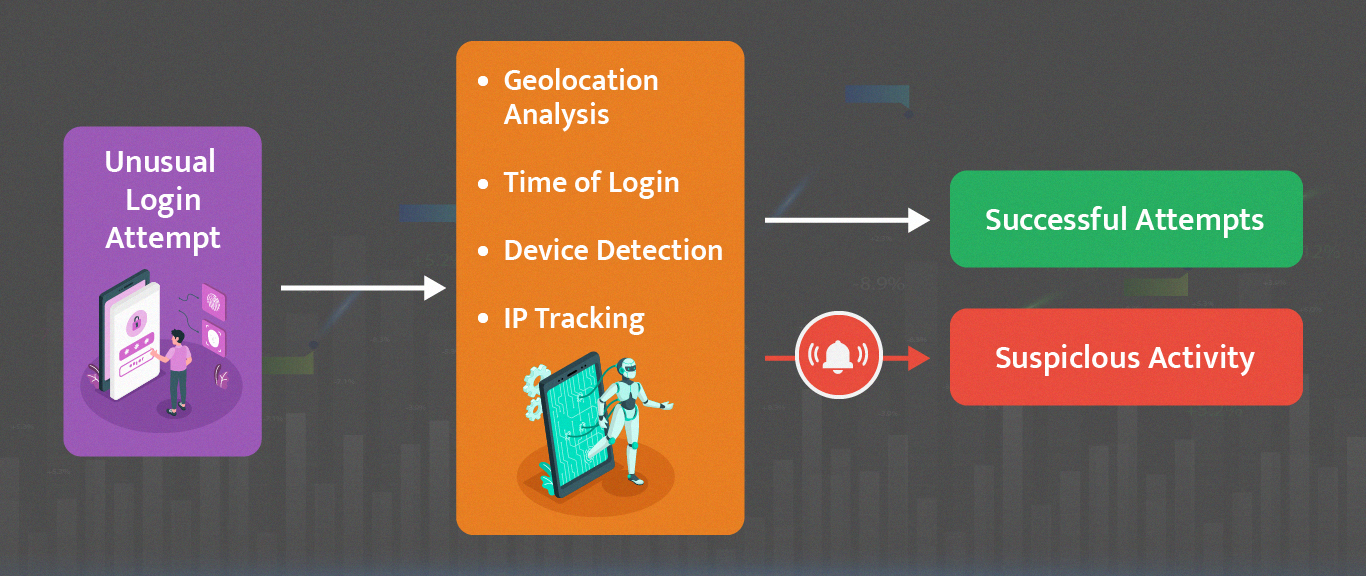

The solution: It includes using strong, unique passwords for each account, enabling two-factor authentication, and being cautious about clicking suspicious links or downloading attachments from unknown senders. Additionally, consider using AI-powered security solutions to detect suspicious login attempts and alert you of potential threats, helping you keep your online accounts safe and secure.

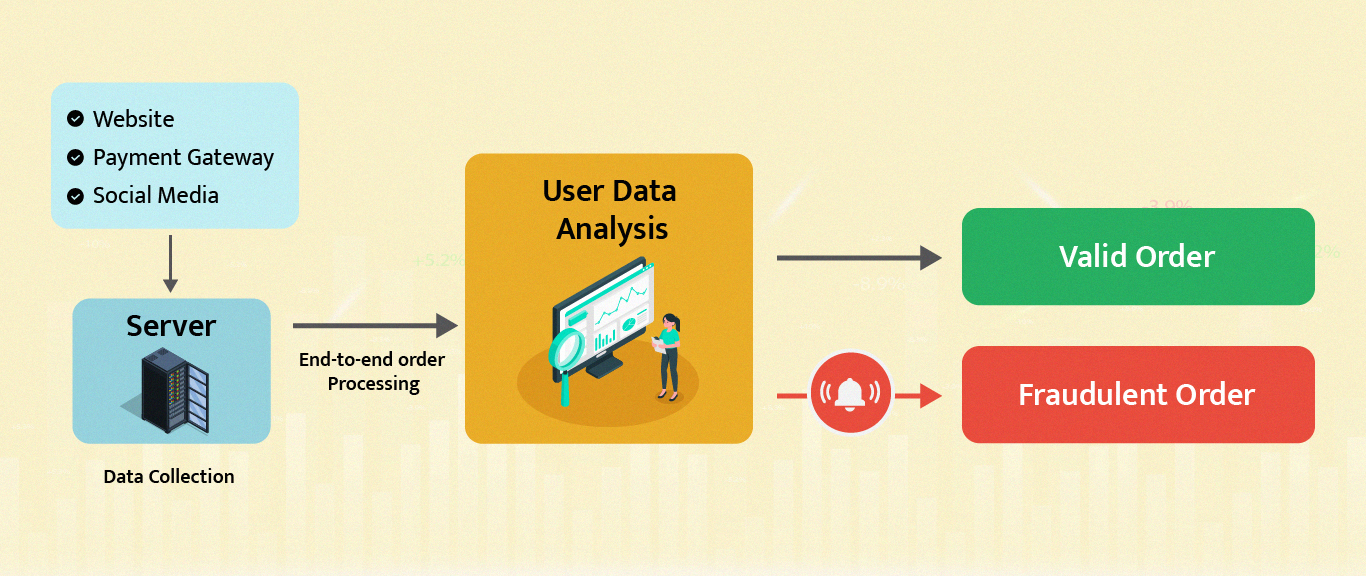

E-Commerce

E-commerce businesses face a significant challenge in the form of online fraud, costing them billions of dollars annually. Artificial Intelligence (AI) emerges as a game-changer in the fight against e-commerce fraud. AI analyzes transaction size, frequency, and purchase history to identify potential risks. It mitigates card-not-present fraud by comparing shipping and billing information for discrepancies, potentially indicating identity theft. AI also combats return and refund abuse by detecting suspicious patterns, saving retailers from costly losses. These systems ensure a secure shopping experience, fostering customer retention and protecting your business.

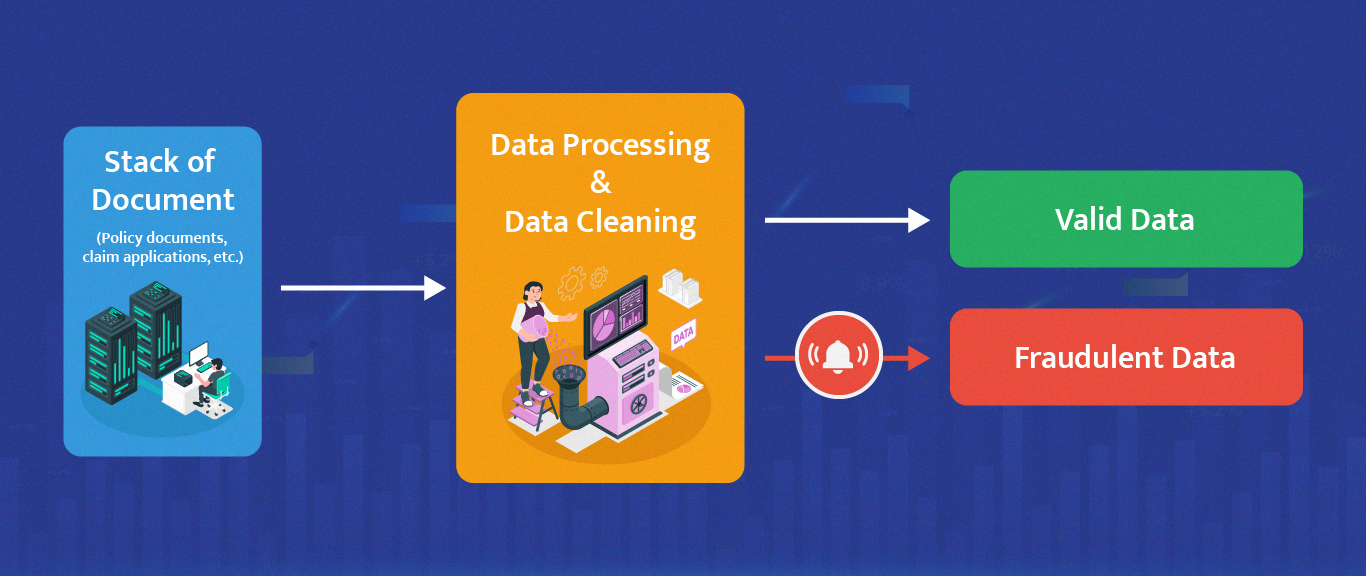

Insurance

Insurance fraud is a significant concern for the insurance industry, costing billions of dollars annually. However, artificial intelligence in fraud detection has overtaken the insurance sector. The cutting-edge technology touches three major areas in the insurance sector.

Exaggerated Claims

Fabricating or exaggerating the billing amounts to receive higher payouts is an alarming matter, and it has been a significant practice by fraudsters.

The Problem: Fraudsters somehow present inconsistent bills with duped photos.

The Solution: AI can significantly reduce these frauds through real-time analysis and image recognition. By analyzing traffic data, weather reports, and police records alongside accident claims, AI can flag claims with inconsistencies. Additionally, advanced image recognition can detect inconsistencies in photos submitted with claims, like damage not matching the reported accident or inconsistencies in timestamps and locations.

Fictitious Claims

Malicious actors present fictitious claims to the insurance company and get actual money from them. Submitting false or inflated medical bills for reimbursement is a severe threat and must be handled cautiously.

The Problem: There can be instances when fraudsters provide fake ownership titles of any asset and state that it is stolen or met with an accident.

The Solution: Fabricating entire claims becomes much more complicated with AI’s ability to cross-reference vast amounts of data. AI can analyze policyholder information, historical claims data, and external databases to identify inconsistencies. For example, a claim for a stolen boat might be flagged if the policyholder has no history of owning a boat or if the reported location of the theft coincides with suspicious activity patterns.

General Frauds

These general frauds happen daily, but are preventable using AI fraud detection practices. Let’s deep dive into each one of them so that you can make an informed decision for your business.

Identity Fraud

Identity protection is quite critical in this digital world. Cybercriminals constantly seek to acquire personal information, such as names, addresses, Social Security numbers, and financial data, for various malicious purposes, including financial frauds, medical identity theft, tax fraud, etc. Unlike static security measures, AI is continually learning. It analyzes your typical online behavior, including financial transaction patterns, login patterns, and account activity.

Artificial Intelligence (AI) offers a dynamic and adaptable approach to identity theft prevention. Considering the normal behavioral pattern of the user, AI sets it as a threshold and alarms, like sending suspicious login attempts on the added email ID, unexplained password changes, and notifying high-risk transactions. Besides, AI in fraud detection even blocks fraudulent logins and transactions to defend fraudsters. As a result, you can expect proactive prevention, risk reduction, quick response time, and peace of mind.

Phishing Attacks

Phishing attacks remain a prevalent and sophisticated threat. Phishing emails disguised as legitimate sources, like banks or social media platforms, aim to steal sensitive information like credit card details and passwords. These deceptive attempts can lead to significant financial losses and identity theft.

Artificial Intelligence goes beyond simple text analysis and delves deeper into various aspects of an email, including Subject line and content, Sender information, and metadata. etc. Moreover, cutting-edge technologies like Machine Learning and behavioral analysis models promise to differentiate between legitimate and spam emails. Besides, they can identify and adapt to new phishing tactics and emerging trends, staying ahead of attackers.

Empower your team to easily detect and prevent fraud. Hire AI developers to build robust, secure, powerful threat detection solutions.

Benefits of Using AI in Fraud Detection

Fraudulent activity is a persistent threat across industries, causing financial losses, reputational damage, and operational burdens. At Bacancy, we believe using AI in fraud detection is an innovative and dynamic approach needed to combat this challenge.

Enhanced Accuracy & Efficiency

We leverage AI algorithms to analyze vast amounts of data in real-time, pinpointing subtle patterns and anomalies that might escape human detection. This translates to more accurate AI fraud detection and significantly reduced false positives, saving you valuable time and resources.

Proactive Approach

We create AI-powered solutions that predict the likelihood of fraud based on historical data and user behavior. This allows for preventive measures to be taken, stopping fraud attempts before they occur and safeguarding your organization from harm.

Adaptability & Continuous Learning

Our AI fraud detection solutions constantly evolve, learning from new data and adapting to new fraud tactics. This ensures you stay ahead of even the most sophisticated fraudsters, no matter their changing schemes.

Network Analysis

Our AI expertise allows us to develop systems that identify connections between seemingly unrelated transactions or accounts, potentially uncovering large-scale fraud rings and coordinated attacks.

Reduced Operational Costs

By preventing fraud, AI minimizes financial losses and frees up resources that can be channeled into other areas, maximizing your operational efficiency.

Improved Customer Experience

We ensure a smoother experience for your legitimate customers through faster transaction processing and fewer false positives, fostering increased customer satisfaction and trust.

What Next Apart from AI in Fraud Detection?

Undoubtedly, AI in fraud detection has revolutionized traditional fraudulent activities and responses. With evolving technologies, AI’s role in fraud detection will be more significant, promising even more security and efficiency in the future.

Explainable AI

Understanding AI algorithms can sometimes be a complicated and time-consuming process, especially regarding AI fraud detection and prevention. Still, with explainable AI, the hassle is a thing of the past. It will tell why AI landed on the conclusion of fraudulent transactions. XAI even builds trust in the technology and stakeholders.

Ongoing Authentication

Artificial Intelligence is far, far better than one can even imagine. With ongoing authentication, AI detects how an original user is behaving. For instance, what’s their typing speed, mouse movement, application usage, location, device type, and IP address? Based on the above information, AI predicts whether someone else has taken over the account.

Graph Analytics

Traditional methods need more data and static analysis. Graph analytics empowers AI to expose complex fraud networks by examining connections (users, transactions, accounts). AI algorithms act as detectives, uncovering hidden links and connecting disparate data to identify coordinated fraud, even the most meticulous schemes.

Synthetic Fraud Detection

Synthetic identity fraud, creating fictitious identities using a blend of real and fabricated data, poses a growing threat. Fortunately, AI emerges as a powerful weapon in this fight. AI’s analytical prowess lies in its ability to discern patterns and inconsistencies within data.

Automated Decision-Making Process

Beyond fraud detection, AI can be crucial to decision-making, including blocking transactions, freezing bank accounts, and notifying users using alerts.

Conclusion

Artificial Intelligence has been vital in proactively detecting and preventing financial fraud. However, the potential of cutting-edge technology is only leveraged optimally when combined with AI consultants and developers. When both manpower and automation join hands, all the heavy lifting is off the shoulders of humans, enabling them to interpret the ongoing data.

The human-AI partnership could be essential in keeping you ahead of the competition and protecting your customers’ valuable resources. Our AI developers help you build robust and defensive AI systems that flag as and when required and save resources. As AI technology develops, so will our ability to detect and prevent fraud, ultimately fostering a safer and more secure digital environment for everyone.

Frequently Asked Questions (FAQs)

Yes, this new-age technology is worth an investment. Since it comes with several algorithms that flag unusual activities and block them on behalf of the user. Plus, cutting-edge technology (AI and ML) utilizes historical data to understand user behavior and alarm if anything suspicious is signaled.

You can go through our engagement models, allowing you to choose AI developers hourly, monthly, or fixed-costly. The average cost to integrate AI systems into your digital software to detect and prevent fraud ranges between $1500 – $3000. You can still connect with our AI developers and know the cost breakage of the AI solution for fraud detection and prevention.

Not at all. To understand the cost breakdown, you can connect with our AI developers and subject-matter experts, who will primarily understand your challenges and then let you know the AI possibilities required in your business.

Your Success Is Guaranteed !

We accelerate the release of digital product and guaranteed their success

We Use Slack, Jira & GitHub for Accurate Deployment and Effective Communication.